Since mid-November 2023, Houthi rebels in Yemen have launched attacks on international and commercial shipping in the Red Sea, the Bab-el-Mandeb Strait, and the Gulf of Aden, areas of commercial and military significance. The current geopolitical landscape in the Red Sea region is intricately connected to the intensifying conflict between Israel and Palestine, and arguably to a larger extent, compounded by the broader geopolitical dynamics within the Middle East, particularly between Iran and Saudi Arabia. Furthermore, the emergence, or re-emergence, of adversarial elements along the African coastline, coupled with unfolding geopolitical developments in other areas of the world and the impact of climate change, presents a tangible risk to global maritime commerce.

Houthis leverage Israel-Gaza conflict to launch new series of attacks

On 19 November 2023, the Yemen-based Houthi rebels boarded the Galaxy Leader, a Japanese-operated cargo ship, and seized the ship and its 25 crew members. The incident was the first in a series of attacks on shipping in the Red Sea, Gulf of Aden and, to a lesser extent, in the Arabian Sea in relation to the latest Israel-Gaza conflict. The group, officially known as Ansar Allah (Supporters of God), mainly made up of members from the Zaidi Shia Muslim minority, was responsible for the attack.

Houthi rebels, long known to have been backed by Iran, have historically been motivated by local grievances in Yemen related to perceived political exclusion, economic neglect, government repression, and corruption to stage attacks. However, it was the mass anti-government protests in 2011 during the Arab Spring that saw the group rise in prominence as it subsequently entered into conflict with a Saudi Arabia-backed government, widening Saudi-Iranian competition in the region. While attacks by the group have been predominantly focused onshore, the group has demonstrated significant capability to target the offshore domain as part of this geopolitical rivalry. Indeed, with military assistance from Iran and Hezbollah, the group developed asymmetrical maritime capabilities by adopting the use of weapons such as anti-ship missiles, first used in 2016, and water-borne improvised explosive devices (WBIEDs), also known as “drone boats” or uncrewed surface vehicles (USVs), first used in 2017.

The Houthis have indicated that their latest series of maritime attacks are a reaction to Israeli air and ground operations in the Gaza Strip that have been ongoing since the 07 October 2023 Hamas-initiated attack on Israel. Hamas is similarly affiliated with and supported by Iran. To date, attacks have targeted vessels assessed to be associated with Israel, namely those that are Israeli-owned, flagged, operated, or believed to be en route to Israeli ports. It is, however, notable that several vessels affected by these attacks do not have demonstrable ties to Israel, as Greek, Danish and Irish-owed vessels have also been targeted. This discrepancy has led to broader disruptions in regional maritime activities, with subsequent implications for international trade.

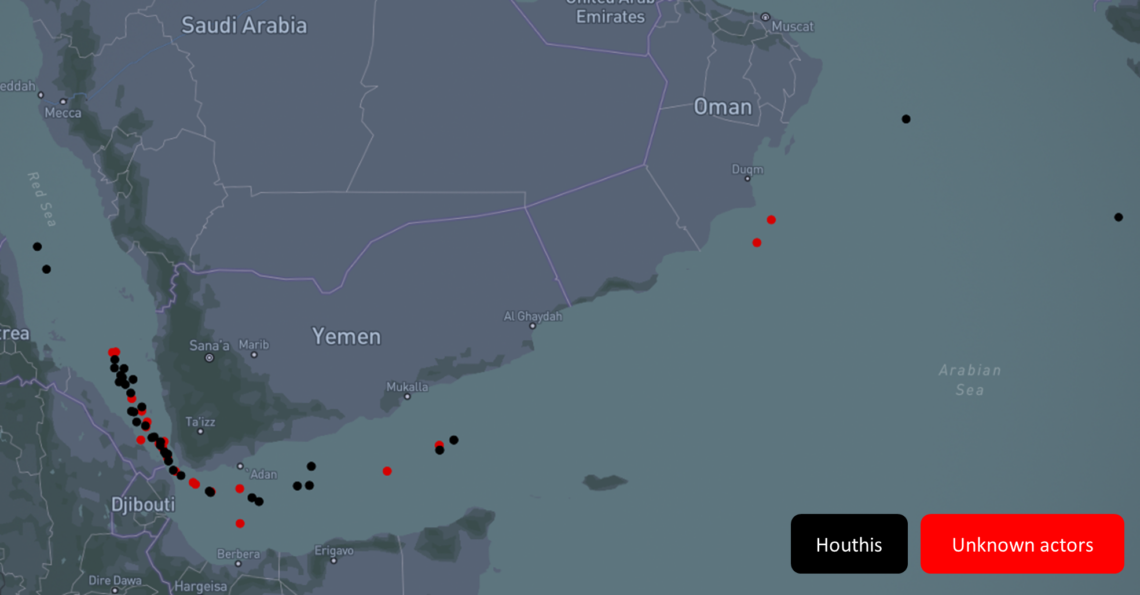

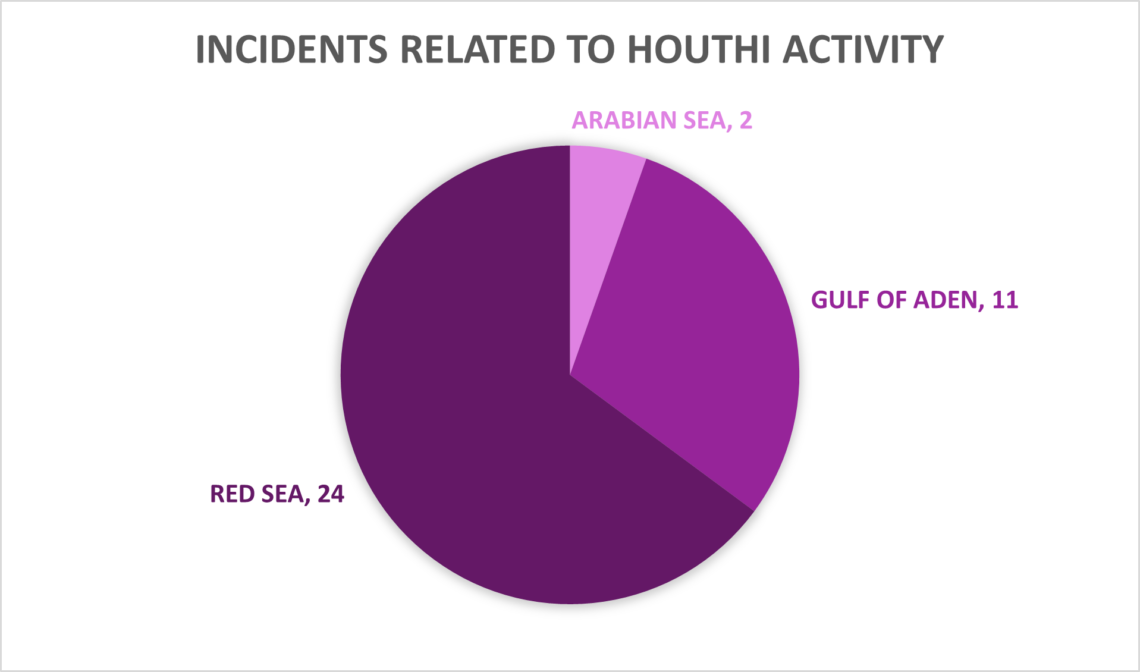

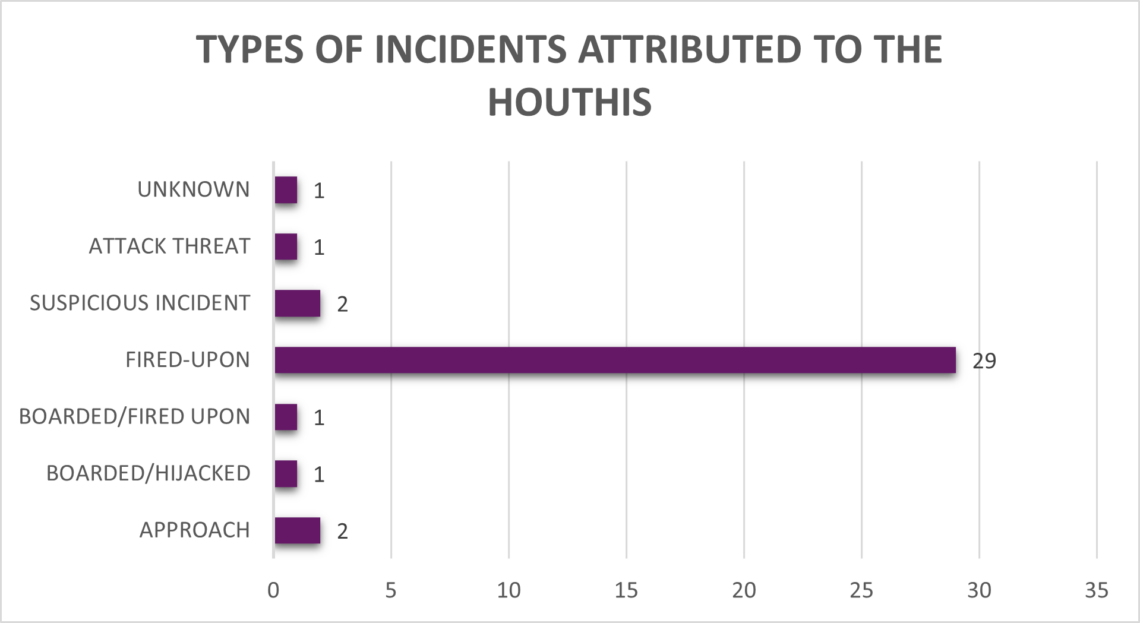

Geography and types of attacks

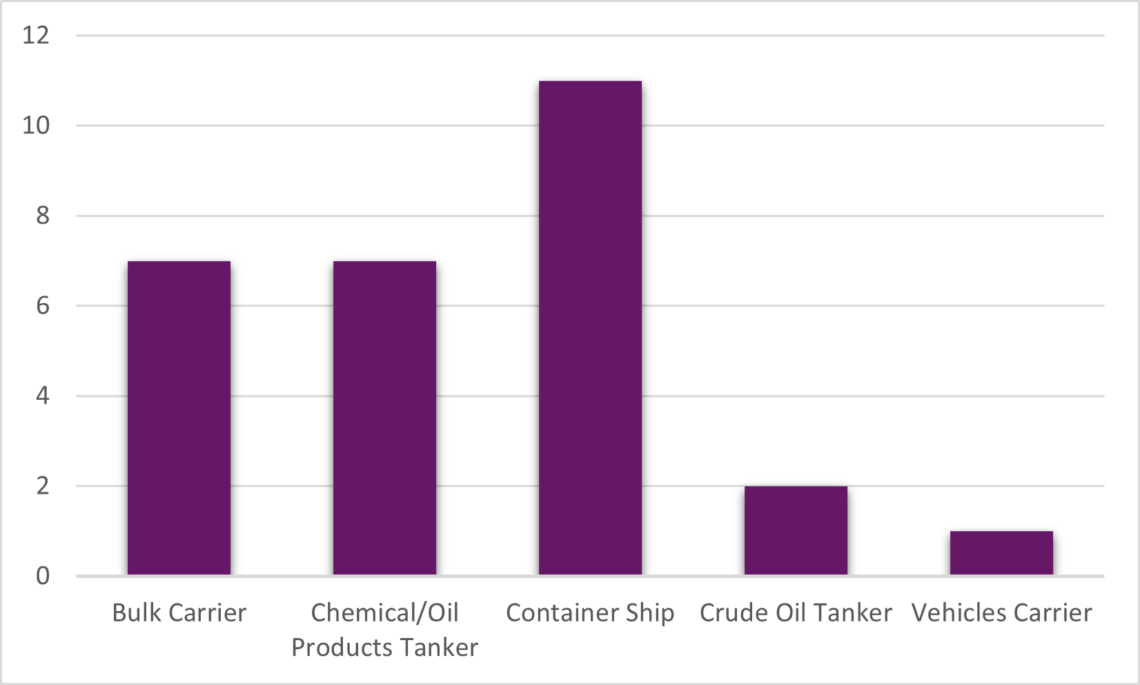

Between 19 November 2023 and 18 January 2024, 61 maritime incidents not related to missile/drone interceptions or piracy occurred in the Red Sea, Gulf of Aden and Arabian Sea. Of these, Castor Vali assesses that at least 37 maritime incidents are attributed to Houthi rebels although this cannot be verified. Types of incidents include suspicious approaches/sightings, incidents where commercial vessels were fired upon, approached, boarded/hijacked or threatened via very high frequency (VHF).

Attack Capabilities

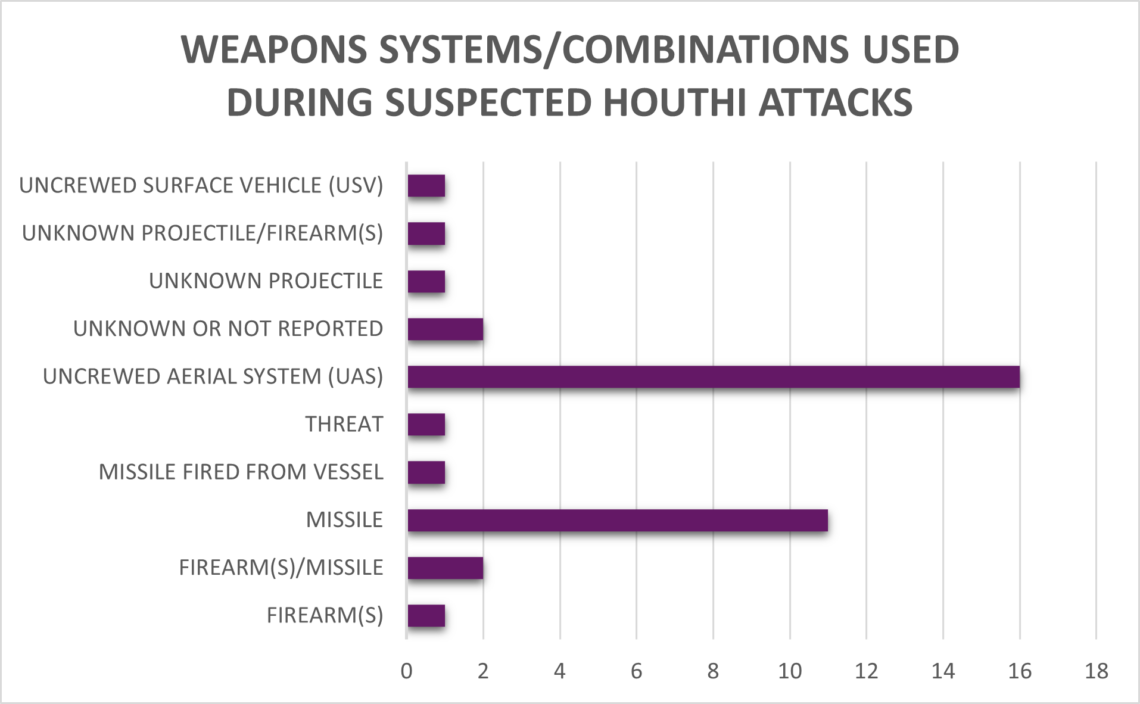

Analysis of the 37 incidents (not including missile/drone interceptions) where commercial vessels were fired upon or approached by suspected Houthi rebels in the Arabian Sea, Red Sea and Gulf of Aden, reveals that uncrewed aerial systems (UASs), were used on at least 13 occasions, five registering hits while cruise, ballistic or anti-ship missiles were used on at least 12 occasions, with seven registering hits. On one occasion an unidentified missile(s) was fired from a vessel. Other weapons systems used include a USV, which missed its target. In one of the 37 incidents analysed, the US claims Iran’s Islamic Revolutionary Guard Corps (IRGC) was partially behind the UAS attack on the Chem Pluto chemical tanker 200 nautical miles south-west of Verval, India. However, Iran’s direct involvement has not been confirmed.

Such attacks highlight the capabilities of the Houthis, who remain a well-armed group with a diverse range of weapons in their arsenal. In the past 24 months, the Houthis have considerably reinforced their land and naval military capabilities, including underwater, as well as their arsenal of missiles and UASs, despite an arms embargo in place. During military parades in Hudaydah and Sana’a in September 2022, for example, the UN 2023 Panel of Experts identified approximately 50 different variants of weapons systems previously not documented. This included ballistic missiles, guided rockets, anti-ship missiles, surface-to-air missiles (including MANPADs), surveillance UAVs, attack UAVs, speed boats, USVs), naval mines, explosively formed penetrators (EFPs), directional mines, Ap bounding mine and electro-optical sensor systems (EOSS). The group, who has established a naval presence on Kamaran Island, off Hudaydah, also possess diver propulsion vehicles (DPVs), that are operated by the group’s naval commando unit, and a range of technicals mounted with heavy machine guns (HMGs), air defence canons, anti-aircraft cannons, recoilless guns, anti-tank guided missiles (ATGMs), mortars, multiple launch rocket systems (MLRS) and rocket launchers.

The West Responds

On 18 December 2023, the US announced Operation Prosperity Guardian to address security challenges in the southern Red Sea and the Gulf of Aden. More than 1,500 international merchant ships have passed safely through the Red Sea since Operation Prosperity Guardian started. The US refrained from direct confrontation with the group until 31 December when US Navy helicopters fired on a group of small boats attempting to board a container ship. According to analysis of data from ACLED, between 15 November 2023 and 14 January 2024, the US, UK and France have intercepted at least 56, one-way attack drones, three anti-ship cruise missiles, six anti-ship ballistic missiles and three unspecified drones.

In response to continued Houthi attacks on vessels, the US and UK have also launched air strikes against targets in Yemen, including Houthi radar systems, production facilities and munition depots but have failed to deter the group from carrying out attacks on shipping. US National Security Council spokesman John Kirby stated that it is too soon to assess the impact of strikes but said they would disrupt and degrade the Houthis’ capability to conduct military offensive operations. Conversely, on 18 January 2024, President Joe Biden admitted air strikes were not deterring Houthi militants. On Monday 15 November the group said UK and US vessels had become “legitimate targets” due to the strikes launched by the two countries in Yemen.

Commercial Impact

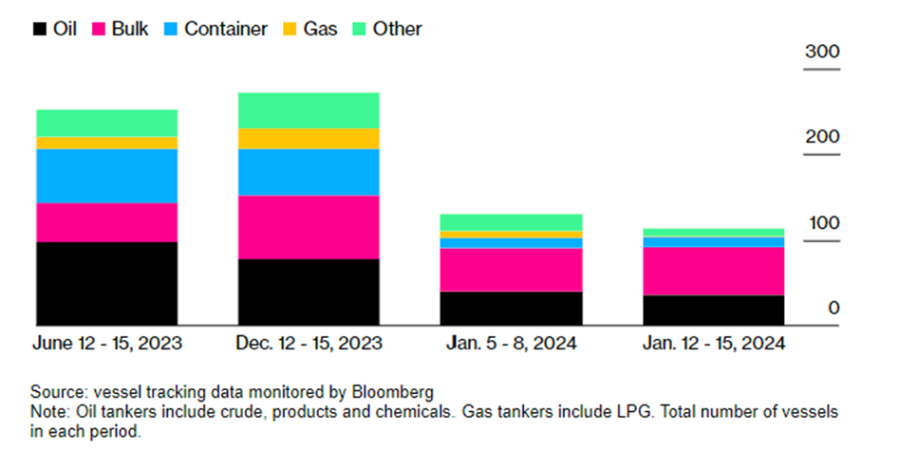

The waters around Yemen remain crucial to global trade with around 12 to 15 percent of global trade traveling through the Red Sea via the Bab al-Mandab Strait. Moreover, according to TradeWinds, about 10 percent of the world’s seaborne oil trade passed through the Red Sea via Suez Canal in 2023. However, as a result of the conflict, according to Bloomberg analysis on 19 January 2024, the number of cargoes transiting the Suez canal has fallen by 40 percent from a year ago with a commensurate increase in voyages around the Cape of Good Hope instead.

Indeed, there has been a sharp decline in container ships approaching the Gulf of Aden, which feeds into the narrow Bab-el-Mandeb Strait: 272 fewer vessels – including oil tankers, bulk carriers and container ships – passed into or out of the Red Sea between 12 January and 15 January compared to the same period last year.

Outlook

Shipping

The trend of container-ship diversions around the Cape of Good Hope is likely to continue in the coming months. The number of bulk carriers and tankers rerouting around Africa’s Cape of Good Hope is also highly likely to increase in the short-medium term despite the journey adding between 12 to 18 days for cargo travelling between Singapore and northern Europe or the eastern Mediterranean. This is not only due to the threat of attacks by Houthis but because of the increasing cost of insurance through the Red Sea. According to insurance broker Marsh, the premium to insure a USD 100 million container ship has increased from USD 10,000 to USD 700,000.

Longer tanker transit times around the Cape of Good Hope could create a supply shortage of tankers. Container ship and tanker diversions are also highly likely to cause ocean spot rates to rise. Further disruption also comes in the form of congestion, natural hazards and security. African ports, not equipped to handle large amounts of traffic, have faced increased demand for marine fuel. Rough weather, common off the coast of South Africa, Mozambique and Madagascar, mean ships could burn through their fuel quicker. Additionally, aging equipment and port infrastructure at African ports will contribute to congestion, as is the case outside the ports of Durban and Richards Bay in South Africa, for instance.

Piracy and crime

Congestion at chokepoints and ports further create ideal conditions for piracy and crime. Indeed, there has been a resurgence of hijackings and attempted hijackings off the coast of Somalia and in the Gulf of Aden in recent weeks. The hijacking of the Maltese-flagged vessel Ruen on 14 December 2023 was the first hijacking of a merchant ship by Somali pirates since 2017. Uncorroborated reports suggest Al Shabaab militants in the Sanaag Region of Somalia have reportedly reached a deal with Somali pirates to provide protection in exchange for a cut from ransom received. The group is yet to officially confirm the agreement.

Maritime conflict

The Houthis themselves are highly likely to continue to carry out attacks primarily in the Red Sea and Gulf of Aden given the array of weaponry they possess and continued backing from Iran. Although a regional war is a less likely scenario in the short-medium term given the sustained disruption it would cause in the long term to global trade and economy, tensions between Israel and pro-Iran actors in the region remain high.

In the short- to medium-term, if air strikes by the US and UK do have a considerable effect on the ability of Houthis to launch missiles and UASs, the group could elect to use asymmetric weapons including sea mines, USVs and WBIEDs. Close attention also needs to be given to Hezbollah as further military escalations across the Lebanese border may likely lead to increased activity by the group in the maritime arena, specifically the eastern Mediterranean Sea. Unverified reports state Houthis are considering implementing a plan they call the “Al-Aqsa Triangle,” by closing the three main waterways in the Middle East: Bab al-Mandab, the Strait of Hormuz, and the Suez Canal. While it is unclear if the group has the capacity to initiate such a plan, Iran’s Revolutionary Guards have warned they could force the closure of waterways other than the Red Sea if “America and its allies continue committing crimes” in Gaza, echoing previous threats by Iran to block the Strait of Hormuz, a vital waterway for global energy supply.

Our Services

Castor Vali has supported maritime clients off the coast of Yemen for over a decade with the full suite of risk management services, from intelligence reporting to maritime security provision.

To learn more about our services see here.

Security Information Service Trial

Clients interested in trailing our subscription packages should complete this form: