Ruling party poised for supermajority amid moderate – high electoral risks

Overview of Tanzania’s 2025 General Elections

Tanzania is scheduled to hold its national general elections on Wednesday 29 October 2025. Voters will choose the President, 264 Members of Parliament, and 3,960 ward representatives. In addition, voters in Zanzibar will elect the island’s President and 76 Members of the House of Representatives. The upcoming polls follow the local-level elections held in November 2024, during which the ruling Chama Cha Mapinduzi (CCM) party secured a decisive victory, winning 95% of the seats.

According to the Independent National Electoral Commission (INEC), a total of 37.6 million voters are registered for the October elections, representing a 26.5% increase compared to the 2020 polls. Of these, 50.34% are women, while 49.66% are men. The official campaign period commenced on 28 August and ran until 27 October 2025. Several regional and international Election Observation Mission groups have been deployed in the country ahead of the vote.

Presidential Race and Key Candidates

The INEC has cleared 17 candidates to contest the presidency, alongside more than 500 candidates for parliamentary seats and over 4,500 for the councillor slots. Among the presidential contenders is President Samia Suluhu Hassan of the ruling Chama Cha Mapinduzi (CCM). This will be her first direct bid for the presidency, having assumed office in 2021 after the death of former president John Magufuli. Her campaign agenda highlights the continuity of her four-year leadership, anchored on Vision 2050, with a focus on industrialisation, universal health care, and youth employment.

Notably, two major opposition parties – the Party for Democracy and Progress (Chadema) and the Alliance for Change and Transparency (ACT-Wazalendo) – have been barred by the INEC from fielding presidential candidates. Chadema’s nominee, Tundu Lissu, was disqualified after refusing to sign the electoral code of conduct and now faces treason charges linked to his call for an election boycott pending electoral reforms. Similarly, ACT-Wazalendo’s candidate, Luhaga Mpina, was disqualified following a legal challenge by the Office of the Attorney General. The remaining 16 presidential candidates, drawn from smaller parties with limited grassroots presence and financial capacity, are unlikely to mount a meaningful challenge to CCM’s long-standing political dominance.

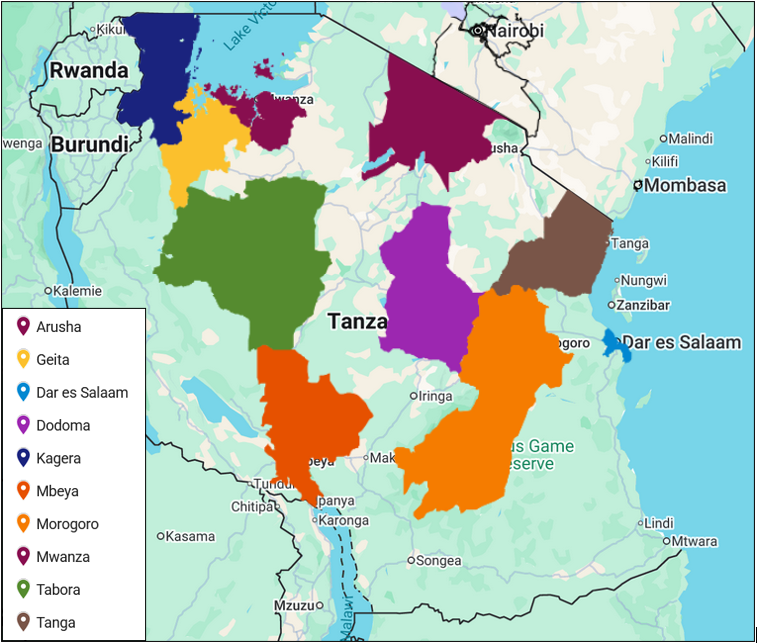

Key Battleground Regions and Voter Turnout Trends

Dar es Salaam, Kagera, Dodoma, Tanga, Geita, Mwanza, Morogoro, Tabora, Mbeya and Arusha are highly likely to be decisive in shaping the outcome of the election, owing to their numerical strength of registered voters. Together, these ten regions account for 53.7% of the electorate. Of the 37.6 million registered voters nationwide, Dar es Salaam holds the largest share at 11.7%, followed by Mwanza (6.02%), Morogoro (5.61%), Tabora (4.78%), Kagera (4.68%), Dodoma (4.64%), Tanga (4.34%), Geita (4.07%), Arusha (4.06%) and Mbeya (3.79%).

Voter turnout, however, will ultimately be the decisive factor. In the 2020 general election, only 50.73% of registered voters cast their ballots, compared with 65.35% in 2015, as shown in the graph below. While populous regions carry significant electoral weight, the real test lies in the ability of political parties to mobilise their supporters.

The disqualification of Chadema and ACT-Wazalendo presidential candidates is likely to reduce competitiveness in the presidential race, shifting much of the contest to parliamentary and ward-level seats. Furthermore, likely voter boycotts in opposition strongholds could depress turnout, particularly in the presidential vote.

CCM Positioned for a Landslide Victory

The disqualification of the main opposition presidential candidates has effectively cleared the path for President Hassan to secure her first direct electoral mandate since succeeding John Magufuli. Hassan still benefits from the advantages of incumbency, with access to state resources along with the CCM’s strong local party structures.

Chadema and ACT-Wazalendo had been regarded as CCM’s strongest challengers. Of the 16 remaining opposition parties, only the Civic United Front (CUF) was represented in the outgoing National Assembly, holding just three of the 393 seats. By contrast, CCM commanded 365 seats, equivalent to 93% of the legislature. This overwhelming dominance underscores CCM’s entrenched grip on the political landscape and strengthens projections of a sweeping victory in the presidential, parliamentary, and ward-level polls, mirroring last November’s local elections, where CCM secured a commanding majority.

Additionally, the gender breakdown, 50.34% women and 49.66% men, presents a nearly equal electoral base, but it also points to the growing political influence of women voters. This gender balance could play a critical role in ensuring President Hassan’s landslide victory as well as shape future campaign strategies and policies, with parties likely to amplify issues affecting women, such as healthcare, education, and economic empowerment. The near parity also demonstrates progress toward inclusive participation, though actual turnout rates will ultimately determine how this demographic translates into political influence on election day.

Implications of a Hassan Presidency

A projected victory for President Hassan would cement her position as East Africa’s first female-elected president, while extending CCM’s uninterrupted rule since 1977. Such a win is likely to elevate her influence within the East African region and strengthen her visibility at both continental and global levels as a duly elected female head of state. Domestically, it would also secure continuity, enabling her to fully implement her manifesto, which builds on the priorities of her first four years in power.

Nonetheless, her administration continues to face criticism for perpetuating what opponents describe as electoral authoritarianism, an approach evident during the 2020 election under her predecessor. Detractors argue that her government has aligned with state institutions, particularly the electoral and security bodies, to restrict political space. Allegations also include the suppression of dissent and media freedoms, alongside the silencing of government critics and opposition figures through arrests, abductions, disqualifications, and procedural hurdles.

Election-Related Risks and Security Outlook

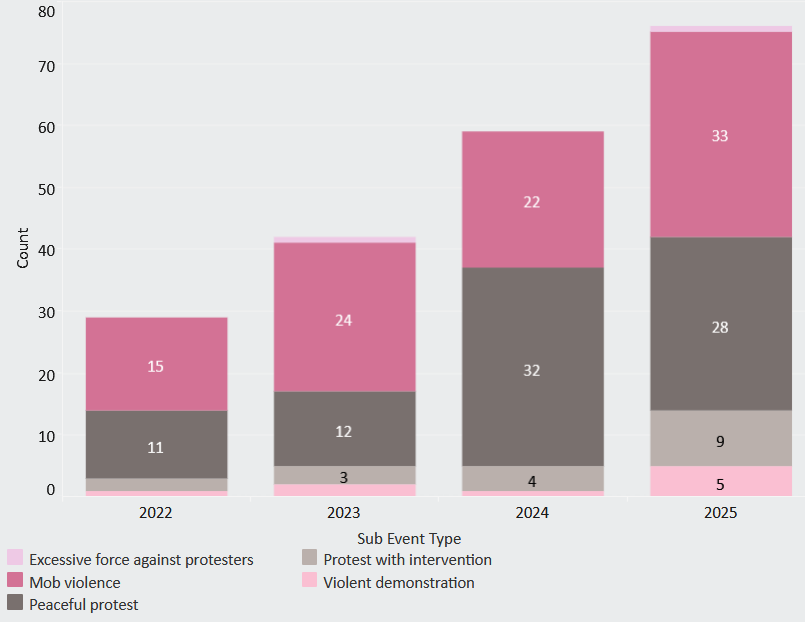

The election-related risks are assessed as moderate to high. So far in 2025, 75 incidents of unrest have been recorded, of which 44% have been acts of mob violence and 37% have been peaceful protests. This contrasts with the 46 incidents reported throughout 2024, indicating an upward trajectory in unrest ahead of the October vote. Some of the drivers of this threat posture include:

- Voter apathy and boycotts: In strongholds of Chadema and ACT-Wazalendo, voter apathy or boycotts are likely. This raises the risk of localised unrest, particularly in regions such as Arusha, Singida, Kigoma, and Mara, where Chadema has a traditional support base. Additionally, the competitive nature of parliamentary and ward elections further increases the potential for unrest in other contested areas.

- Electoral irregularities: Reports of voter bribery and other violations of electoral rules in favour of the ruling party are also likely to be reported. Such practices are likely to drive localised unrest across the country.

- Security force response: Police and military heavy-handedness against the opposition and protesters is highly likely. Opposition leaders, especially those linked to Chadema and ACT-Wazalendo, face increased risks of surveillance, arrests, abductions, or house arrest in the days surrounding the polls. Chadema leader Lissu is likely to remain in custody through the election period, increasing tension within the Chadema strongholds.

- Media and internet restrictions: Mainstream and social media platforms are likely to face restrictions and censorship in the coming days and after the elections. Internet disruptions are highly likely, aimed at curbing the spread of anti-government narratives and the sharing of unverified election results. These measures could impact business operations, especially in sectors dependent on connectivity.

- Restrictions on foreigners: Certain election observers and foreign nationals, whose presence may be deemed questionable, could also face restrictions. These measures are likely to involve enhanced screening by police and immigration officers at airports and border crossings, disrupting normal activities and movement at some key government installations.

While these actions may infringe on individual freedoms, media independence, and political rights, they are likely to suppress widespread unrest. Overall, the risk rating remains moderate to high and within a manageable threshold, allowing for business continuity in the country post the vote.

How Castor Vali Supports Election Monitoring and Risk Analysis

As part of its mission, Castor Vali’s Security Information Service (SIS) provides intelligence-led reporting to equip clients with critical insights for navigating complex security and political environments. The SIS team compiles a range of reports offering detailed assessments of the national security landscape. The upcoming election period is being closely monitored, with the team providing regular updates on key developments in the run-up to the October vote.

Security Information Service Trial

Clients interested in trailing our subscription packages should complete this form: